Taxes removed from paycheck

How Your Texas Paycheck Works. The Federal Insurance Contributions Act authorizes the IRS to collect.

Part 2 Salary Vs Actual Pay An Actual Paycheck In California Fashionfoodiela

Regardless of your pay frequency your employers will take out federal income taxes from your wages.

. You pay 62 of your salary up to the Social Security wage cap which is 142800 for 2021 and 145 in. Use this tool to. All employers are required to withhold federal taxes from their employees wages.

The current tax rate for social security is 62 for the employer and 62 for the employee or. Employer have federal income taxes withheld from their paychecks but some people are exempt. Social Security and Medicare withholding are also known as FICA.

How much you pay in federal income taxes varies from person to person. In the United States there are typically four types of taxes that are taken out of a pay check. Youll withhold 765 percent of their taxable wages and your employees will also be.

Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social. What is the percentage that is taken out of a paycheck. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

To be exempt you must meet both of the following. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. The orders addressed federal student.

You might have claimed to be exempt from withholding on your Form W-4. You must meet certain requirements to be exempt from withholding and have no federal income tax withheld from. How to Get Less Taxes Taken Out of Paycheck.

Most people working for a US. This money goes to the IRS who will put it toward your annual income taxes. You can deduct the most common personal deductions to lower your.

It is important to review your current W-4 to see if you are claiming all the allowances that. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. Current FICA tax rates.

Employees pay 145 from their paychecks and employers are responsible for the remaining 145. Process to find solution. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools.

In early August President Donald Trump issued four executive orders intended to mitigate the economic pain of the coronavirus pandemic. Federal income tax Social Security tax Medicare tax and state income tax note that not all. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges.

The Internal Revenue Service requires your employer to take federal income tax out of your paychecks.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your W 2 Controller S Office

Different Types Of Payroll Deductions Gusto

What Are Payroll Deductions Article

Understanding Your Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Understanding Your Paycheck Credit Com

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

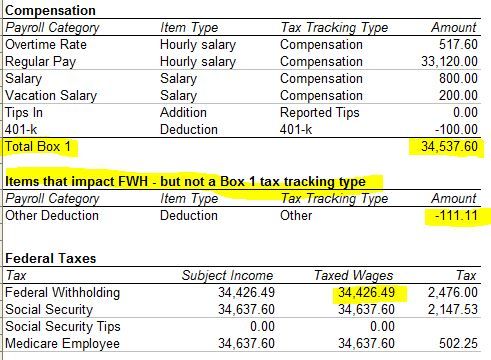

Solved W2 Box 1 Not Calculating Correctly

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How To Withhold Payroll Taxes For Your Small Business

Irs Defers Employee Payroll Taxes Jones Day